The New Gold Rush: How China's Critical Mineral Monopoly Shapes Our Future

- Team NorthStar

- Jun 19

- 3 min read

Updated: Jul 28

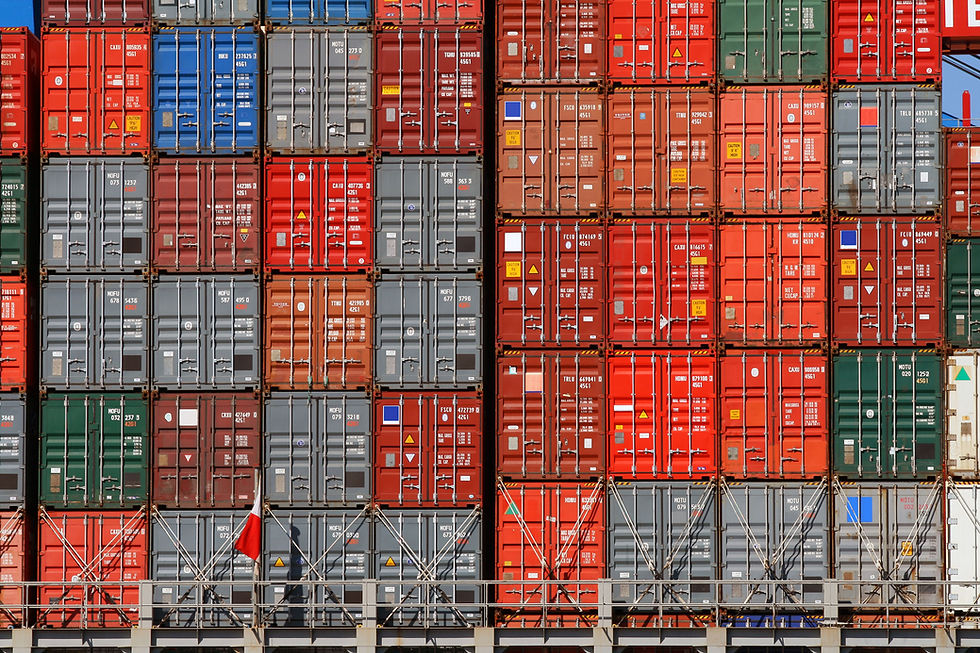

In this explainer piece, our team discusses the battle for critical minerals and how it is shaping global politics. In the age of great power competition, critical minerals hold the key to moving the world's supply chain.

Executive Summary

China dominates global critical mineral supply chains, controlling approximately 61% of rare earth production and over 90% of processing, which provides significant geopolitical leverage.

This strategic dominance is the outcome of a deliberate, long-term Chinese vision, established in the early 1990s, to control essential inputs for future technologies.

Other nations are actively pursuing diversification strategies, including investments in alternative processing capabilities like Australia's Lynas, to reduce reliance on China world is racing to build a greener, more technologically advanced future.

From the electric vehicle in your driveway to the wind turbine powering your home, the very fabric of this future relies on something most people rarely consider: critical minerals. These aren't your everyday rocks; they're the essential ingredients for everything from EV batteries and wind turbines to smartphones and advanced defence systems. And right now, the global supply of these vital resources is largely controlled by one nation: China.

The soaring demand for these finite resources is sparking a new global resource race, reshaping alliances, and fuelling geopolitical tensions. To understand China's current dominance, we need to go back to the early 1990s. In a pivotal 1992 visit to Inner Mongolia, the late Chinese leader Deng Xiaoping, who famously oversaw China's economic reforms, declared: "The Middle East has oil and China has rare earths." This statement wasn't just a boast; it was a clear articulation of a long-term strategic vision.

While the world focused on oil, China quietly and methodically established a near-monopoly over critical mineral supply chains, particularly rare earths. How did they achieve this? By leveraging lower labour costs and, in many cases, a less stringent approach to environmental regulations. This strategic foresight allowed China's political leadership to realise that controlling the inputs for future technologies—like renewables—would ultimately give them significant leverage in the global power dynamic.

Today, the numbers speak for themselves. The International Energy Agency (IEA) estimates that China accounts for about 61% of rare earth production and an astounding 92% of their processing. This isn't just about having the raw materials; it's about controlling the intricate and resilient supply chains that turn those raw materials into usable components. This unparalleled control allows China to wield its monopoly as a geopolitical tool in trade negotiations, conflict resolution, and other international interactions.

The world's reliance on China for critical minerals has prompted nations to seek diversification. While countries like the Philippines and Indonesia possess significant raw material reserves, much of the crucial processing capability remains in the hands of Chinese entities. This reliance has compelled nations across the Asia-Pacific (APAC) region and beyond to actively seek ways to move away from and diversify their supply chains.

One notable challenger to China's processing dominance is Lynas Rare Earths from Australia. What's particularly fascinating about Lynas is the significant investment it has attracted from countries actively trying to de-risk and reduce their reliance on China's monopoly. For instance, in 2010, soon after the Senkaku crisis, the Japan Organisation for Metals and Energy Security (JOGMEC) allocated $250 million to invest in Lynas.

By 2023, Lynas was supplying over 90% of Japan's neodymium and praseodymium needs—two critical rare earth elements essential for electric vehicle production. Japan, keenly aware of the vulnerabilities, has indicated a "dual-track" approach. This involves striking a balance between investing in domestic innovation and diversifying supply chains through rules-based international partnerships. This strategy aims to ensure that climate targets can still be met without undue geopolitical exposure.

The control of critical minerals is no longer just an economic issue; it's a fundamental aspect of national security and geopolitical power. Most recently, Lynas announced that it had reached a preliminary deal with the Malaysian government over access to rare earths - all in a bid to break China's monopoly. Questions have emerged, however, that Lynas's capabilities are limited as local and national infrastructure is poor, requiring continued investment in the long run.

As the world races towards a greener, technologically advanced future, the competition for these vital resources will only intensify. Understanding China's strategic long-term vision and its current dominance is crucial for navigating this evolving global landscape.

If you would like to learn more about what this means for your business, please contact us at ceo@northstar-insights.com

Comments