De-Risking Trade in a Fragmenting World: The IMEC Bet Amid Rising Instability

- Team NorthStar

- Jul 4

- 3 min read

Updated: Jul 5

In this insightful explainer, guest writer Bandish Oza meticulously examines the future of the India-Middle East-Europe Economic Corridor (IMEC) amidst the complexities of current geopolitical instability.

Executive Summary:

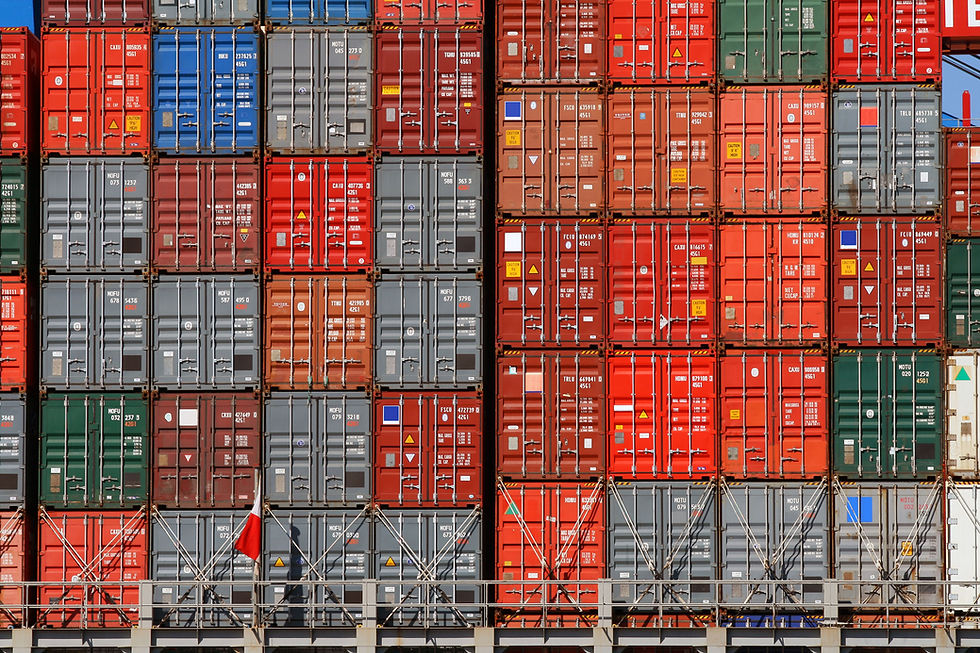

Launched in 2023, the India-Middle East-Europe Economic Corridor (IMEC) offers a vital, stable trade alternative, bypassing vulnerable traditional paths like the Red Sea.

Geopolitical tensions highlight its "risk premium" but simultaneously prove the urgent need for such diversified trade corridors.

Strong diplomatic ties, stable transit nations, and key investments underpin its feasibility and significant economic potential.

The India-Middle East-Europe Economic Corridor (IMEC) which was launched at the Group of Twenty (the G20) summit in 2023 was pitched as a transformative trade route that links India to Europe via Arabian Peninsula and Eastern Mediterranean, bypassing traditional routes like the Red Sea. However, the ambitious trade corridor is stalled by geopolitical realities of a turbulent region. Israel-Iran conflict paired with US involvement raised questions about IMEC’s feasibility. At the same time, the conflict also highlights the dire necessity of investing in alternatives to traditional trade routes like the IMEC.

There are two sides to geopolitical risk surrounding IMEC:

1. Growing Geopolitical Risk Premium of Multilateral Trade Projects

The IMEC case illustrates how large-scale multi-modal collaborative infrastructure is not just a matter of economics. The geopolitical risk premium of these projects in an increasingly volatile world is measured not just in delays or rising insurance costs, but in the reputational and diplomatic capital that states must expend to make them viable. For instance, the Red Sea crisis earlier this year led to catastrophic spikes in freight insurance premiums, but it simultaneously raises the cost of investment along that route, repelling investors and forcing them to consider alternatives.

2. Over-reliance on Traditional Routes – Which are no Safer

While IMEC is put in perpetual limbo due to its perceived unsafety, alternative routes are just as vulnerable to geopolitical realities, if not more. Iran’s repeated threats to choke the Strait of Hormuz and Houthi blockades to choke Bab al-Mandab Strait have resulted in 75% reductions in container shipments along this route, with alternative detours costing 10-14 days, triggering a cascading relay of astronomical additional costs and supply-chain disruptions. Thus, it becomes all the more imperative for businesses to invest in contingencies to the traditional trade routes – IMEC offers just that.

What Makes IMEC Work?

Within a geopolitically volatile region, overland IMEC passes through relatively stable nations like UAE and Saudi Arabia, unscathed by regional conflicts. Israeli businesses have already tested these overland routes to circumvent the Houthi blockades with promising results. Moreover, IMEC does not pass through Iran, which is a great source of instability in the region. What lends further credibility to IMEC is the intricate diplomatic relations between participating nations. Jordan and Israel have had a peace agreement since 1994; Abraham Accords established unprecedented diplomatic ties between Israel and UAE. India’s massive convening power with stellar diplomatic ties with UAE, Saudi, Jordan, Israel, EU, as well as Iran gives further hope to make IMEC work.

Indian conglomerate Adani Group owns and operates 70% of the Israeli Haifa Port which is the gateway of IMEC into the Mediterranean, a port that was unaffected by Iranian missiles in the recent skirmish. All this paired with Saudi and UAE’s ambitions for greater role in global trade and the massive capital they bring, makes IMEC more feasible than it looks. Pitting its potential risks against the rewards, which include reduction of logistics costs by 30% and transport time by 40%, and much more, it is up to businesses to decide if the rewards outweigh the risks.

Beyond its function as a trade route, IMEC is assessed as a strategic commitment by participating nations, reflecting a strong emphasis on economic pragmatism to overcome regional geopolitical turbulence. It is our assessment that there are some risks involved, but they are neither unprecedented nor insurmountable. Investing in IMEC entails chasing opportunity while securing resilience. For businesses, investors and states, the question is no longer whether they can afford to build such contingencies, but whether they can afford not to.

If you would like to learn more about what this means for your business, please contact us at ceo@northstar-insights.com

Comments